Featured News

All Conveyancing News

Why Does An Owners Corporation Certificate Have To Be Current?

If the property that you’re considering buying is affected by an Owners Corporation that is not inactive, in accordance with subsection 32F(1)(a) of the Sale of […]What’s Different When You’re Buying A Newly Constructed House?

If you buy a newly constructed dwelling, some differences apply: You may be eligible for the First Home Owner Grant, if you are first home buyer […]What’s The Temporary Off-The-Plan Stamp Duty Concession?

If you buy a dwelling off the plan in a strata subdivision on or after 21/10/2024 but before 21/10/2025, you will eligible for the off-the-plan stamp […]The Steps for Land Subdivision in Victoria: What You Must Know

If you want to secure your finances and protect your family’s future you might have thought about investing in properties and why not? Property investment is […]Information For Buyers – Money and Settlement

If you’re buying a property, at settlement you are obligated to pay the seller the adjusted settlement price. If you have a lender There are two […]4000 Electronic Settlements and Counting

Glenferrie Conveyancing Pty Ltd was the first firm in Australia to be registered as a practitioner subscriber of the PEXA electronic settlement platform, and we conducted […]What Happens If a Property Owner Dies?

Here’s what happens to a property if the owner dies: Joint Ownership: If there’s a surviving owner, they can apply for a survivorship transfer to become […]Electronic Lodgement from 1 October 2018

It has been a Registrar’s Requirement to lodge almost all Transfer dealings at Land Use Victoria using an electronic settlement system since 1 October 2018. That […]What Happens After You Sell Your Property?

If you’ve sold your property and your contract has become unconditional, the following things occur: Your conveyancer advises the purchaser’s conveyancer if the sale is subject […]What Happens at (electronic) Settlement?

At settlement the parties to the Contract (the buyer and seller) fulfill their obligations. The buyer and/or their lender (the Incoming Mortgagee) provides the balance of […]What is a Section 27?

The deposit paid by the purchaser under a contract will generally remain in trust until settlement, when it is then released to the vendor. However, sometimes […]How Electronic Settlement Saves You Money

electronic settlement is now compulsory in Victoria for all settlements apart from a few relatively rare exceptions. What are the savings with electronic settlement, compared to […]What is a Section 32?

Section 32 of the Sale of Land Act 1962 (Vic) prescribes that a vendor must give a signed statement to the purchaser before the purchaser signs […]What’s the Problem with Paper Certificates of Title?

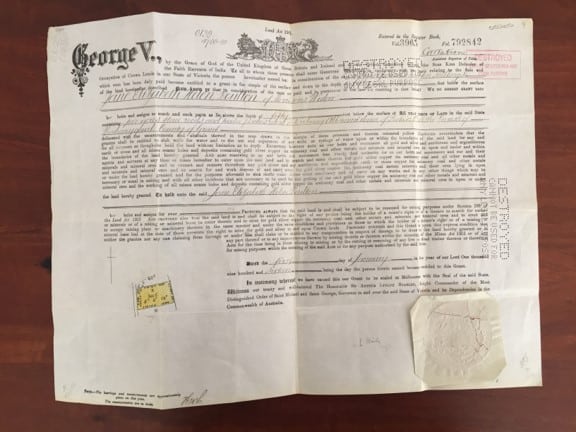

Many people who own land without a mortgage hold their paper Certificate of Title. Particularly, the older parchment ones are quite beautiful. However, there is a […]What is GST Withholding?

If you’ve bought a new residential property since 1 July 2018, or one that that has been substantially renovated, then GST usually forms part of the […]Progress with Electronic Settlement

Why is electronic settlement such a good thing for buyers and sellers? 1. Once an electronic settlement has been made Ready by all of the parties […]Verification of Identity

Since November 2015, it’s been a Land Victoria requirement that any person who’s buying or selling property has to have their identity verified. This includes the […]The 4 Major Banks And Electronic Certificates Of Title

On 23 October 2016, every Victorian paper Certificate of Title that was first mortgaged on that day to one of the four major banks (i.e. ANZ, […]Your Wish is Granted – Help for First Home Owners

If you’ve been looking to buy your first home in Victoria you might be thinking that you’re facing an uphill battle. Between finding that first home […]What Is Partition?

If you are a part owner of land that has been subdivided into two lots, you are able to “partition” the land so that after the […]What Are Material Facts?

Section 12(d) of the Sale of Land Act 1962 has been amended with effect from 1 March 2020 so that a seller who knowingly conceals any […]The Top 7 Things to Be Careful of When Selling a House

Not all of these issues apply to all types of sales. However, failure to disclose any of them if applicable in your Section 32 Vendor’s Statement […]What Are The Obligations Of A Buyer?

If you’ve bought a property, you (and your conveyancer) have the following obligations: Pay the deposit in full by its due date, usually to the selling […]The Top 7 Things to Beware of When Buying a House

Not all of these warnings apply to all types of purchases: The proposed Contract contains Special Conditions that are oppressive to your interests. Special Conditions add […]Obtaining A Certified Copy Of Your Power Of Attorney

If you have been appointed as the Attorney for another person or a company (“the appointor”), and you wish to execute a dealing on the title […]What’s Different About a Property Transfer Between Related Parties?

A full or part interest in a property can be transferred between related parties. Examples of related parties include spouses, domestic partners, family members, friends, business […]Why You Should Not Buy A Property Subject To A Building Inspection

In general, vendors won’t permit buyers to purchase a property subject to a satisfactory building inspection. This is because a purchaser’s satisfaction standard is subjective. Instead, […]What’s changed with Foreign Resident Capital Gains Withholding?

From 1 January 2025 the Foreign Resident Capital Gains (FRCG) withholding regime will now apply to all sales of real estate in Australia, previously this only […]When Can You Object To a Section 27 Deposit Release Request?

A purchaser can object to a request for early release of the deposit from trust on three different grounds: If there is a mortgage over the […]Who Can We Refer You To?

Glenferrie Conveyancing works closely with a range of trusted small business partners. We can refer our clients to the following professionals: A building and pest inspector, […]What Is The Commercial And Industrial Property Tax?

If you buy a commercial or industrial property on or after 1 July 2024, it will be an entry transaction affected by the new commercial and […]Who Decides The Settlement Date?

The settlement date is usually agreed between the buyer and the seller, and this is written into the contract as an essential term. Buyers need to […]What’s Happening On 3 August 2024?

From 3 August 2024, all new certificates of titles in Victoria will be mandatorily issued in electronic form. Up until that date, the conveyancer, legal practitioner […]What Are Fixtures And Goods Sold With The Land?

A fixture can be defined as anything that cannot be removed without leaving a defect. On the other hand, goods sold with the land or chattels are items that are […]What Is A Licence Agreement?

A Licence Agreement is a supplement to the sale of land contract that allows one of two things: The purchaser(s) to occupy the property for a […]Land Tax Is No Longer Apportionable (in most cases)

Effective from 1 January 2024, the Sale of Land Act 1962 has been amended to prohibit the apportionment of land tax between the purchaser and the […]How Do Trusts And Superannuation Funds Buy Property?

Although trusts and superannuation funds are legal entities that pay tax, they cannot own property themselves directly. If a trust or superannuation fund wants to buy […]How Are Utilities And Rates Handled In A Conveyance?

The Adjustments general condition of a contract of sale of real estate reads as follows: The periodic outgoings and rent and other income is apportioned on […]When Do I Need A Property Valuation?

Are you asking yourself when you need a property valuation? First, let’s talk about stamp duty. Stamp duty is calculated on the dutiable value of the […]What If I’m A Foreign Purchaser?

If you’ve not an Australian or New Zealand citizen, and you don’t hold a permanent visa allowing you to be in Australia, then you are regarded […]What Happens If A Registered Proprietor Has Died?

If you’ve bought a property and a registered proprietor has died, then either: There is a surviving joint proprietor or proprietors, who can lodge a survivorship […]Is Conveyancing For Rural Properties Different?

If you buy a property in rural or regional Victoria, you may see a few differences from buying a home in Melbourne. The property: May not […]What Happens If You Buy A Property Subject To Lease?

If you buy a property subject to a lease, then at settlement you become the landlord and are bound by the terms and conditions of the […]What Is Cooling Off?

Cooling off is the purchaser’s right to end a contract for the sale of real estate within 3 clear business days of the day that they […]What Is A Partial Interest Title?

If a property has more than one owner, and they own the property as tenants in common, typically A and B are shown as tenants in […]As A Purchaser, When Do I Have To Pay The Vendor’s Legal Costs?

Contracts drafted by vendors occasionally include special conditions that require the purchaser to pay the vendor’s legal costs. However, subsection 42(3) of the Property Law Act […]What Happens If a Trustee Dies?

Individual trustees are people, and they can die. This is why there are usually at least two individual trustees of a trust, and they own the […]What Is a Section 24 Transfer?

Unless it is released to the vendor by the purchaser before settlement (section 27), the deposit paid by the purchaser under a contract for the sale […]Can I Move Into a Property Before Settlement?

Yes, you may be able to move into a vacant property before settlement with the vendor’s permission. This typically involves a Licence Agreement, in which the […]What is Consolidation?

Consolidation is when the land contained in two or more adjacent titles is consolidated into a single lot and a new child title is issued to […]What is a Caveat?

A caveat is an ex-parte (single party) dealing registered on a title or group of titles that shows the valid interest of that party (the caveator) […]More than 2,000 Electronic Settlements and Counting

Glenferrie Conveyancing Pty Ltd was the first firm in Australia to be registered as a practitioner subscriber of the PEXA electronic settlement platform, and we conducted […]Why Do I Have to Sign a Client Authorisation?

If you are buying, selling or transferring the ownership of property, you will be a party shown on an electronic document called a Transfer, either as […]Is the Property You Buy Going to Be Your Principal Place of Residence?

If the property you are buying going to be your principal place of residence, you may become eligible for several concessions and exemptions: A stamp duty […]How Do You Buy a Property Subject to Finance?

If you’re not buying at auction, it is possible to purchase a property subject to getting a loan approval within a specified time. This is done […]What Are The Steps to Buy a Property?

Step 1: The vendor signs their Vendor Statement (Section 32), a signed statement of matters affecting the land as specified in section 32 of the Sale […]Can Trusts Own Land?

No. Instead, the trustee or the trustees of the trust own the land on behalf of the trust and its beneficiaries. This is why only the […]What Is An Easement?

An easement is the right of a party to use land that does not belong to them. There are two parties to an easement: The Dominant […]Increased Conveyancing Charges From 1 July 2021

Fees for lodging conveyancing documents have increased from 1 July 2021. Examples of the most common fees are: The fee for lodging a transfer without consideration […]How Are Rates Adjusted at Settlement?

In almost all contracts for the sale of land, the periodic outgoings imposed on the land are apportioned between the buyer and the seller. Periodic outgoings […]Why Do I Have to Pay Land Tax at Settlement?

This is an occasional question from clients who are buying a principal residence from an investor. Land tax is assessed each January 1 for that calendar […]What is The Difference Between Joint Proprietorship vs Tenants in Common?

The difference between joint proprietors vs tenants in common is: For joint proprietors, if one dies, the surviving owner automatically owns the property. All joint proprietors […]What Are The Common Stamp Duty Exemptions and Concessions?

Here are some of the most common stamp duty exemptions and concessions that transferees (buyers) may be eligible for: A waiver of 25% off for existing […]How Do You Add a Name to a Property Title?

A prospective client recently called us wanting to “add a name to a title”, and wanting to know if there’s a form that needs to be […]Should you purchase a property subject to a building and pest inspection?

Have you considered the question “Should I purchase a property subject to a building and pest inspection?” Our advice when buying a residence that is not […]How do you make changes to an auction contract?

For a property being auctioned, you should write to the Agent before the auction asking if their client/s would accept bids from you at the auction […]The Ultimate Moving House Checklist: What to Arrange Before Moving Day

After the contract for the purchase of your home has been settled: Your conveyancer will send a Notice of Acquisition to the authorities whose charges are […]What Sellers Must Declare on Their Stamp Duty Form

Sellers don’t have to pay Stamp Duty when they sell land, but they do have to declare information about the land that they’re selling on their […]We are still conveyancing during Melbourne’s stage 4 lockdown

We continue to deal with the challenges of the coronavirus pandemic: We have been working from home since 2012, and are continuing to do so. Our […]Our fees remain unchanged in 2020-21

We are dealing with the challenges of the coronavirus pandemic: We did not increase our fees in 2019-2020, and we have not increased them again for […]First Home Buyer Guide in Victoria

The Duties Act regards you as a first home buyer if: You have never owned a residential property in Australia, or you have purchased a residential […]The Pros and Cons of Buying a Property Off the Plan

If you buy a house, apartment, unit or vacant block of land off a Plan of Subdivision that has not been registered, then you are buying […]What’s the difference between a mortgage and a loan?

A mortgage occurs when a property is offered by its owner to a lender (usually a bank) as security for a loan. The owners of the […]Foreign Resident Capital Gains Withholding Tax (FRCGW): What Property Sellers Must Know

If you’ve sold a property on or after 1 July 2017 for $750,000 or more, you will be liable to have 12.5% of your sale proceeds […]Lost Certificate of Title

In order to settle the sale of your property, you or your mortgagee must provide the original Certificate of Title for the property at settlement. Your […]Selling Property in Victoria: Your Guide to Contractual Obligations

If you’re ready to sell your family home, your investment property or even a holiday house, there are a range of things you have to consider. […]How to Buy Property in Victoria: Your Step-by-Step Guide

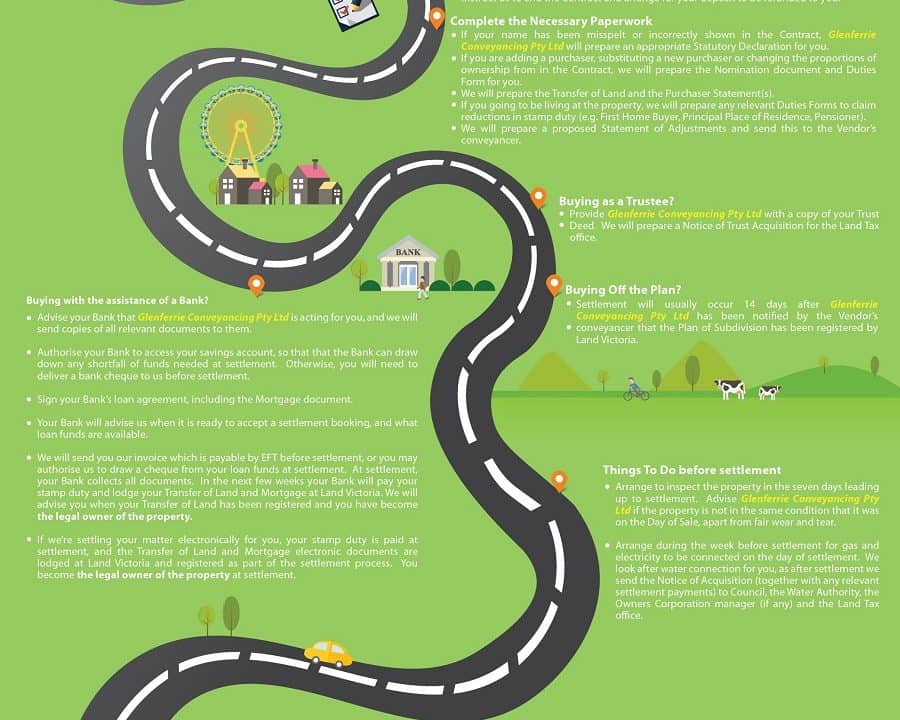

View full size View full size Transcript: Before You Buy. If you would like Glenferrie Conveyancing Pty Ltd to review your proposed Contract and Vendor’s Statement […]Stamp Duty for Foreign Buyers: Costs, Rules, and Updates

There are plenty of costs involved in buying a property but there are also plenty of good reasons to take the plunge. Buying property can mean […]Special Conditions in Property Contracts: What Every Buyer Must Know

When it comes to making the right purchase, modern day consumers are savvy. We don’t just look at a car’s shiny paint job or its great […]