Special Conditions in Property Contracts: What Every Buyer Must Know

September 3, 2015

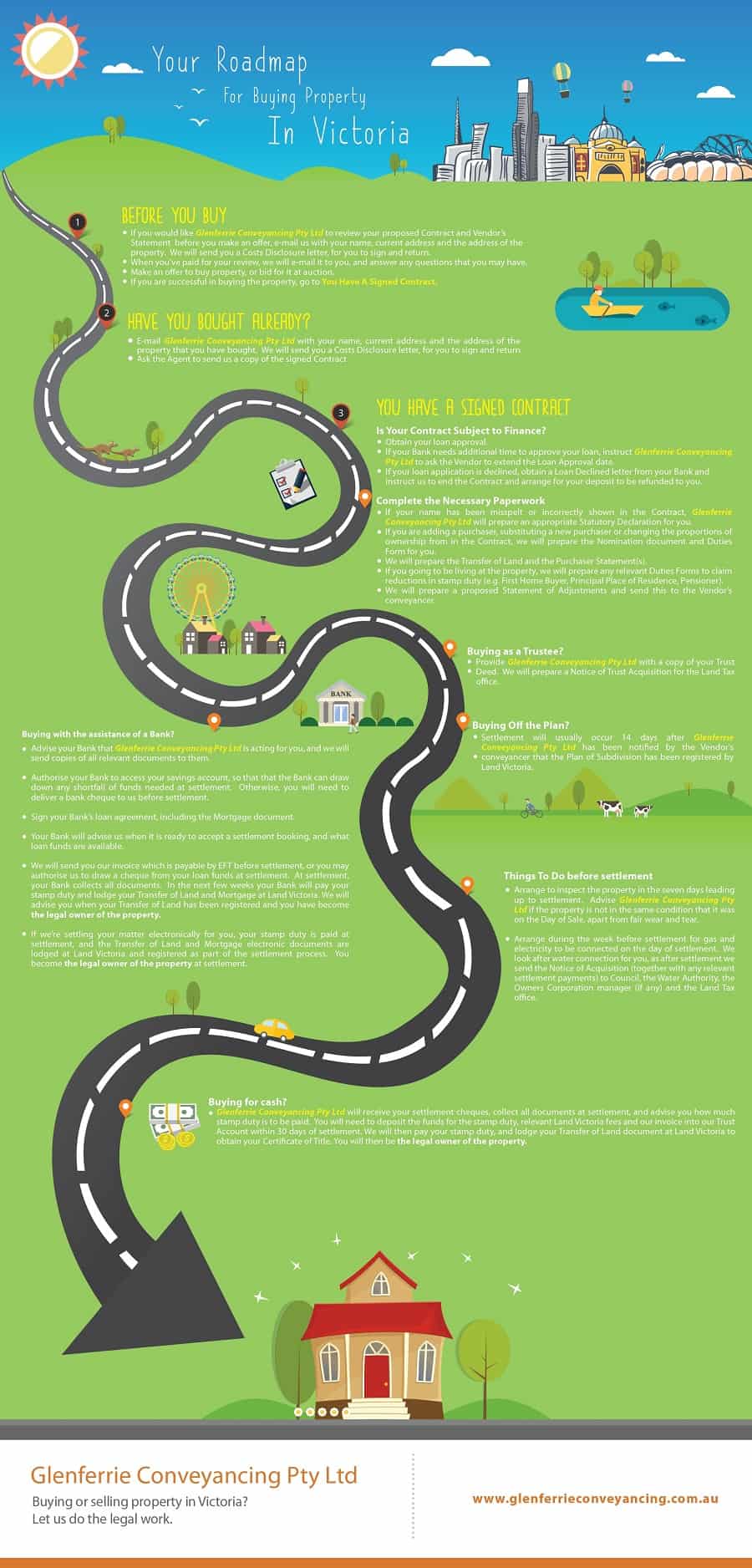

How to Buy Property in Victoria: Your Step-by-Step Guide

November 11, 2015There are plenty of costs involved in buying a property but there are also plenty of good reasons to take the plunge. Buying property can mean getting the keys to your dream home or securing an investment that will diversify your portfolio.

One of the costs involved in buying land in Victoria is stamp duty, which is essentially a tax on land transfer. The amount you will have to pay for stamp duty will be based on its market value, which usually will be the purchase price of your property. To make things even more complicated new rules have been introduced for additional stamp duty for foreign buyers. If you’re looking to invest in property in Victoria and want to know what this means for you as a foreign buyer, please read on.

New Rules Mean Higher Stamp Duty

Residential purchases made on or after 1 July 2015 by foreign buyers are subject to an extra 8% of stamp duty. This applies to all residential Victorian properties – from apartments and high-rise buildings to vacant land that has been zoned for residential use. So how do you know if these rules apply to you?

Am I a Foreign Buyer?

If you’re buying as an individual it’s relatively easy to determine if you’re a foreign buyer. You are a foreign buyer if:

- You are not an Australian citizen and

- You do not hold a permanent resident visa and

- You are not New Zealand citizen who holds a special category visa (Subclass 444). This is the visa that almost all New Zealand citizens receive when they arrive in Australia.

When it comes to purchasing by a corporation or a trustee, things get a little bit more complicated. In detail:

- An Australian corporation controlled by a person or entity that is regarded as a foreign buyer is considered foreign. Control is having more than 50% of the voting power in a company, either directly or indirectly.

- A trust is considered foreign if a person or entity that is regarded as a foreign buyer has a beneficial interest of more than 50% of the capital of the trust, or can determine or influence the trustee’s decisions.

What Does it All Mean for Me?

Stamp duty is the most significant tax involved in property purchase and so it’s important to know exactly where you stand. If you’re based overseas or are considered a foreign buyer under the new legislation, make sure you factor these changes into your purchase costs. Also, if you work with an overseas partner you will need to find out how these new rules might affect your property investment.

Get All the Answers with a Conveyancer

Whether you’re a foreign buyer or not, these changes still mean extra work for you. All purchasers of residential land in Victoria after 1 July 2015 have to complete Duties Form 62 (Purchaser Statement) declaring whether or not you are a foreign purchaser.

If you need help working out where you stand and completing the forms correctly, the expert conveyancers at Glenferrie Conveyancing can help you. We offer flexible and affordable services that take care of all of the legal aspects of buying a property. Our extended hours and commitment to clients makes communicating with us easier, and we can even come to you. We will carefully and expertly determine your purchasing status and complete all the relevant forms you need, doing all of the hard work for you.

If you’re close to Northcote area then contact us today and let us guide you through the whole property buying process.